Working in PawnMaster day to day we mostly write loans, take payments and make sales. Usually, we look at the customer snapshot as a matter of habit to make decisions at the counter without giving it much thought. Let’s dig a little deeper to break down the data we are looking at and possibly discover a trick or two along the way.

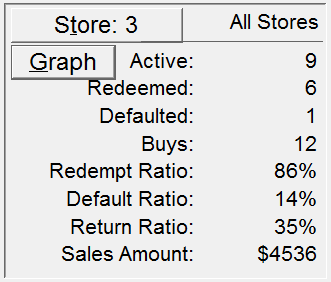

Total Active Loans

Usually, the first thing we look at is the number of “Active” loans, which is the number of current open loans this customer has with you. If you or the customer need to know more, click “Print Current” to see the details of the loans and the total loan amount, or click on the “History” tab to see a list of current loans, redemptions, defaults, and buys.

Number of Redeemed Loans

“Redeemed” is the number of loans the customer has paid off and picked up. This is good news for the pawn shop because they have made a bit money from service charges, we don’t have to worry about pulling and selling defaulted inventory, and the customer is more likely to re-pawn an item they have pawned in the past.

Number of Defaulted Loans

“Defaulted” is the number of loans that have expired without being paid back resulting in the collateral bring pulled and moved to inventory to be sold in the shop. Some pawnbrokers will say that all defaulted loans are “mistakes at the counter” because they should have been buys from the beginning. While this may be true for some defaulted loans, the reality is some of those customers had every intention to pay the loan and redeem the item, but life happened and they couldn’t.

Buys for This Customer

“Buys” is the number of items that the customer has sold to the shop outright. The customer has no intention of picking up the item, so they sell it to the pawn shop for some quick cash and the shop can resell it and turn a profit.

Redemption Ratio for This Customer

“Redemption Ratio”, on the surface this seems simple enough, the percentage of loans the customer has paid off and picked up. According to the National Pawnbrokers Association, the national average is 80% of loans are redeemed.

What is the average redemption ratio for your shop?

You may be asking, “Why is it important for a loan to be redeemed if I can just sell the defaulted collateral?” Well, to start with, defaulted items must be pulled into inventory and that involves man-hours to physically price and move each item. But more importantly, the money that could have been used to write loans is now tied up in inventory, and every month that item sits on the shelf is another month’s worth of interest lost. Also, consider that when an item defaults, that is one less thing that a customer has to use as collateral for future loans.

Default Ratio

The opposite of the redemption ratio is the “Default Ratio”. If you know one, you can easily determine the other but with computer software it is easy to display both.

Return Ratio

“Return Ratio” may well be the most important piece of information here. This is the profitability of each customer. This data point is calculated as each item of collateral leaves the shop. It may be from redemption, sale or even deletion. After a few weeks of using PawnMaster, the pawnbroker should have a good idea of what their average customer’s return ratio is. The collateral presented by any customer who has a significantly lower than average return ratio should be more carefully examined.

Sales Amount

“Sales Amount” is the total amount the customer has spent in the shop. This will always be tracked on layaways and firearm sales where customer identity is required but keep in mind that sales made under “Cash Customer” are anonymous and are not tracked. So while using “Cash Customer” allows you to quickly and conveniently process sales for customers paying with cash, you may be losing valuable data about your customers’ buying habits. Knowing that a certain customer spends thousands of dollars in the shop every year may impact the decisions you make.

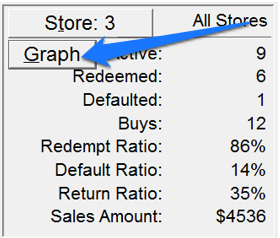

Click That Graph Button!

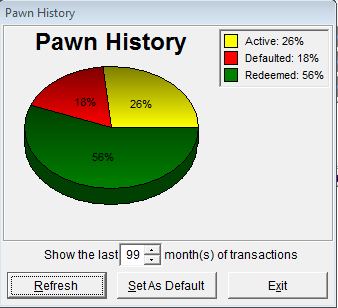

You may have noticed there is a “Graph” button on the customer snapshot. Have you ever clicked on it? Did you notice you can change the number of months of data to display?

If you change the number of months, you can also set that range as the default number of months to be displayed automatically in the future.

Now that you have a better understanding of the information being displayed, I hope this helps you to serve your customers better.